Family Office y Banca Privada

Las FamilyOffices están creciendo en todo el mundo, son cada vez más comunes y se enfrentan a mayores exigencias a la hora de registrar todas las inversiones y los activos que gestionan. comunes y se enfrentan a mayores exigencias a la hora de captar e informar sobre todas las inversiones y activos que están bajo su control.

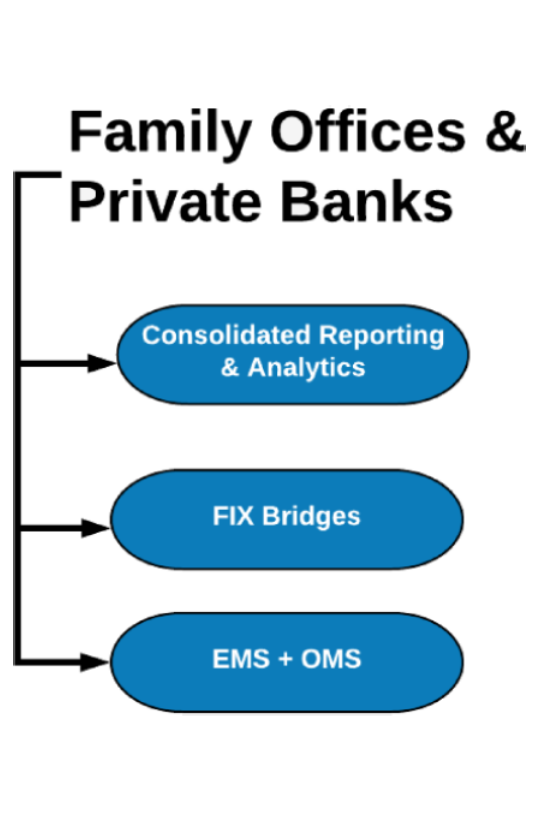

La solución de Family Office de ZagTrader aborda esta cuestión permitiendo que los datos, las posiciones, las operaciones y todo tipo de activos sean capturados y reportados dentro de una única plataforma que es Custodio, Custodio, Contraparte y clase de activos. La misma tecnología que impulsa nuestras soluciones de Custodia, Liquidación y Compensación se combina con nuestras soluciones de Gestión Financiera. Custodia, Liquidación y Compensación se combina con nuestro puente FIX/API y una OMS para permitir que un gestor de Family Office Family Office todos los activos en una única "vista 360", al tiempo que se conecta con contrapartes y contrapartes y corredores para cualquier activo cotizado o negociable.

Las Family Offices y los gestores tendrán la capacidad de consolidar y supervisar múltiples cuentas de Private Banking o Trading, relaciones y clases de activos. Con conectividad a través de EMSX, Bloomberg, TSOX, AUTEX, FIX, conectores personalizados o cargas automatizadas de archivos planos, así como datos globales integrados en tiempo real y acciones corporativas (escisiones, dividendos, etc.).

Gestión patrimonial completa todo en uno

- CRM y panel de control de clientes

- Contabilidad

- Modelización y reequilibrio de carteras

- Transacciones bancarias

- Informes dinámicos

- Gestión de pedidos y procesamiento comercial

- Tarifas

- Alertas y notificaciones

- Custodia

- Gestión de riesgos

- Banca Privada

- Gestión de patrimonios

Multiactivo. Multidivisa. Multilingüe

La plataforma ZagTrader Family Office & Private Banking - soporta estructuras jurídicas complejas y cambiantes y todas las clases de activos. Esto incluye una amplia gama de clases de activos líquidos e ilíquidos con tipos de transacciones específicas de clases de activos como alquileres contratos de alquiler, gestión general de inquilinos para REITS o activos inmobiliarios o o compromisos de capital privado (PE), así como la gestión de fondos de renta variable privada.

La Plataforma soporta Fondos Cotizados (ETFs) ETDs como futuros y opciones, caridad, fundaciones benéficas y filantropía, incluida la alimentación de datos de diversas fuentes como ICE Data o Refinitiv (anteriormente conocido como Thompson Reuters), FX- forwards y todo tipo de inversiones ilíquidas inversiones ilíquidas como participaciones directas, préstamos, arte, objetos de colección, barcos/jets y energías renovables y otros, así como las intrincadas estructuras organizativas, las inversiones complejas, los mercados fluctuantes y los retos operativos son parámetros críticos a la hora de gestionar sin fisuras el patrimonio de las family offices. Las hojas de cálculo y las soluciones informáticas en silos provocan pérdidas de tiempo, crean ineficiencias y pérdidas que podrían ser irreversibles.

La plataforma ZagTrader Family Office & Private Banking ofrece a las a las family offices una solución única y completa para la gestión de sus carteras gestión de carteras, negociación y contabilidad de inversiones.

La plataforma ZagTrader Family Office & Private Banking ofrece a las family offices individuales y multifamiliares una herramienta completa, flexible y totalmente integrada para racionalizar las operaciones y los informes diarios.

Potente y fiable

- Gestione la cartera, la negociación y la contabilidad de las inversiones con una única solución.

- Genere informes consolidados con cálculos de inversión.

- Racionalización y automatización de la contabilidad del inversor para una asignación precisa y sin fisuras de los activos, ganancias y pérdidas entre varios miembros de la familia.

- Modele y reequilibre la cartera en todas las cuentas con valores liquidativos en tiempo real.

- Capacidades de cumplimiento mejoradas para cumplir normativas cada vez más complejas.

- Facturación automatizada para una gestión rápida y fluida de los ingresos.

- Aumenta la competitividad del family office y la banca privada y pone el listón muy alto para que la competencia se ponga al día.

Mejore la experiencia de sus clientes con la aplicación web y móvil de ZagTrader, que incluye informes dinámicos

Crecimiento potencial y oferta multicapa con

ZagTrader Family Offices & Private Banking

Plataforma

- Evaluación en tiempo real del patrimonio neto de múltiples entidades para oficinas familiares individuales y múltiples. familiares.

- ETFs / ETDs / productos estructurados personalizados.

- Lleva la contabilidad de todos los eventos, incluidas las distribuciones de ingresos, los pagos de facturas y otros desembolsos.

- Agregar datos para proporcionarles a ellos y a sus beneficiarios una visión global de 360 grados.

- Utilizar el acceso directo al mercado a intermediarios de todo el mundo.

- Acceso a precios y datos en tiempo real.

- Relaciones con los clientes (por ejemplo, empresa, familia, etc.).

- Preferencias, tarifas e informes personalizados.

- Comercio mundial instantáneo de:

- Acciones

- Bonos y Sukus

- Letras del Tesoro

- Arte / Coleccionismo

- Gestión de inquilinos / propiedades

- Derivados

- Divisas y tipos de cambio

- REITS / Fondos inmobiliarios

- Caridad y filantropía

- Activos tradicionales y digitales

- Gestión y asesoramiento patrimoniales

- Servicios de custodia

Aproveche todas las oportunidades con un software

para ayudar a los profesionales de Relaciones con Inversores a maximizar sus relaciones

Principales ventajas Aumento de la eficacia y la productividad

- Herramientas de evaluación comparativa, reequilibrio y análisis de escenarios

- Enrutamiento automático de órdenes para la misma estrategia, cuenta o beneficiario a múltiples cuentas y relaciones

- Sistema integrado de gestión de órdenes y ejecución con reequilibrio automático y enrutamiento de corredores algoritmos

- Herramientas de evaluación comparativa, reequilibrio y análisis de escenarios

- Apoyo a la toma de decisiones y gestión de carteras

- Visión global de 360 grados de todas las cuentas y posiciones en múltiples niveles

- Multi-Asset Trading, Multi-Market con soporte para múltiples posibles centros de enrutamiento por mercado

- Escalabilidad para soportar grandes volúmenes de operaciones, normas de cumplimiento, cuentas y grupos de cuentas. grupos de cuentas

- Cubre más de 200 mercados (incluidos Estados Unidos, Europa y Oriente Medio): Con más de 200.000 símbolos para elegir

- Soporte para múltiples custodios, corredores y estructuras de comisiones

- Procesamiento post-negociación automatizado con gestión de excepciones y reglas de liquidación definidas por el usuario reglas definidas por el usuario

- Distribución de datos a los gestores de cartera, cuentas y clientes de Family Office

- Confirmaciones automatizadas de operaciones, instrucciones de liquidación, casación posterior a la operación, liquidación y conciliación

- Interfaz de usuario, panel de control y ajustes eficaces y fáciles de usar

- Informes automatizados con informes personalizados en múltiples formatos de archivo

- Gestión de sus empleados: Sistema completo de privilegios/permisos con automatización completa de flujos de trabajo y procesos

- Reducción del riesgo y la intervención manual: Automatización de la incorporación de clientes

- CSC y gestión de documentos

- Capacidad para encaminar sus pedidos a múltiples destinos

- Gestión de riesgos y negociación algorítmica

- Movilice a sus clientes con aplicaciones de marca blanca para móviles y tabletas para ver y negociar su cartera en tiempo real con una solución de marca blanca

- Ampliar el negocio a millones de clientes locales y miles de millones en todo el mundo

- Arquitectura escalable y orientada al servicio desarrollada para ofrecer un acceso fiable de baja latencia y acceso de alto rendimiento en todas las condiciones del mercado

- Conectividad FIX directa con el centro para órdenes y/o alimentación de precios; Alimentación externa de datos/precios opciones de conectividad

- Conectividad con: AUTEX, EMSX, NYFIX, TSOX, Dark-pools, Prime brokers y cualquier destino compatible con FIX. destino

El mundo a su alcance

El mundo a su alcance

Los clientes operan donde y cuando quieren

Más de 200 mercados mundiales

Datos de mercado en tiempo real. Compra / Venta en múltiples mercados

Interfaz única integrada

Todos los departamentos conectados en UN solo sistema

Calcular tasas y gastos

Gravamen y cálculo de tasas y cargos en tiempo real con auditoría e informes completos

Conecte el sistema bancario central en tiempo real

Sincronización en tiempo real y acceso al sistema bancario central

Escalable y rentable

Introducir nuevos productos Generar nuevas fuentes de ingresos. Múltiples soluciones, incluidas las gestionadas, alojadas, coubicadas e in situ; opciones para ofrecer la máxima disponibilidad y escalabilidad basada en la carga.

Tecnología integrada de extremo a extremo

Aplicaciones para ordenadores de sobremesa, tabletas y móviles con 2FA para que los operadores puedan supervisar y gestionar constantemente el flujo de operaciones de forma totalmente segura. Estandarización y gestión de FIX para permitir la integración rápida y eficiente de nuevas conexiones y mejorar la experiencia de incorporación de los clientes y satisfacer las demandas empresariales.